Payroll Adjustments

October 13, 2024About 1 min

Payroll Adjustments

The folder is used define the type of payroll adjustments that are

applicable to the payroll for the defined period. To define the payroll

adjustments, please follow the following

- Once you have logged into your SARALWEB admin account, select

Payroll Adjustment folder. The folder will open on your screen.

Previously defined adjustments will be listed on your screen - You will see Actions button on the top left hand side. Click on it

and you will find two options namely Create Payroll Adjustments

and Export Folder - As the name suggest, Create Payroll Adjustments is used to define

a leave type for the organisation.

Creating an Adjustment

Click on Actions and select Create Payroll Adjustment . A create

payroll screen tab will open up on the your screenFill in the following details

Payroll Period - Select the period for which the defined adjustment will be applicable for.

Employee Id - Select the employee for whom the adjustment is being defined for.

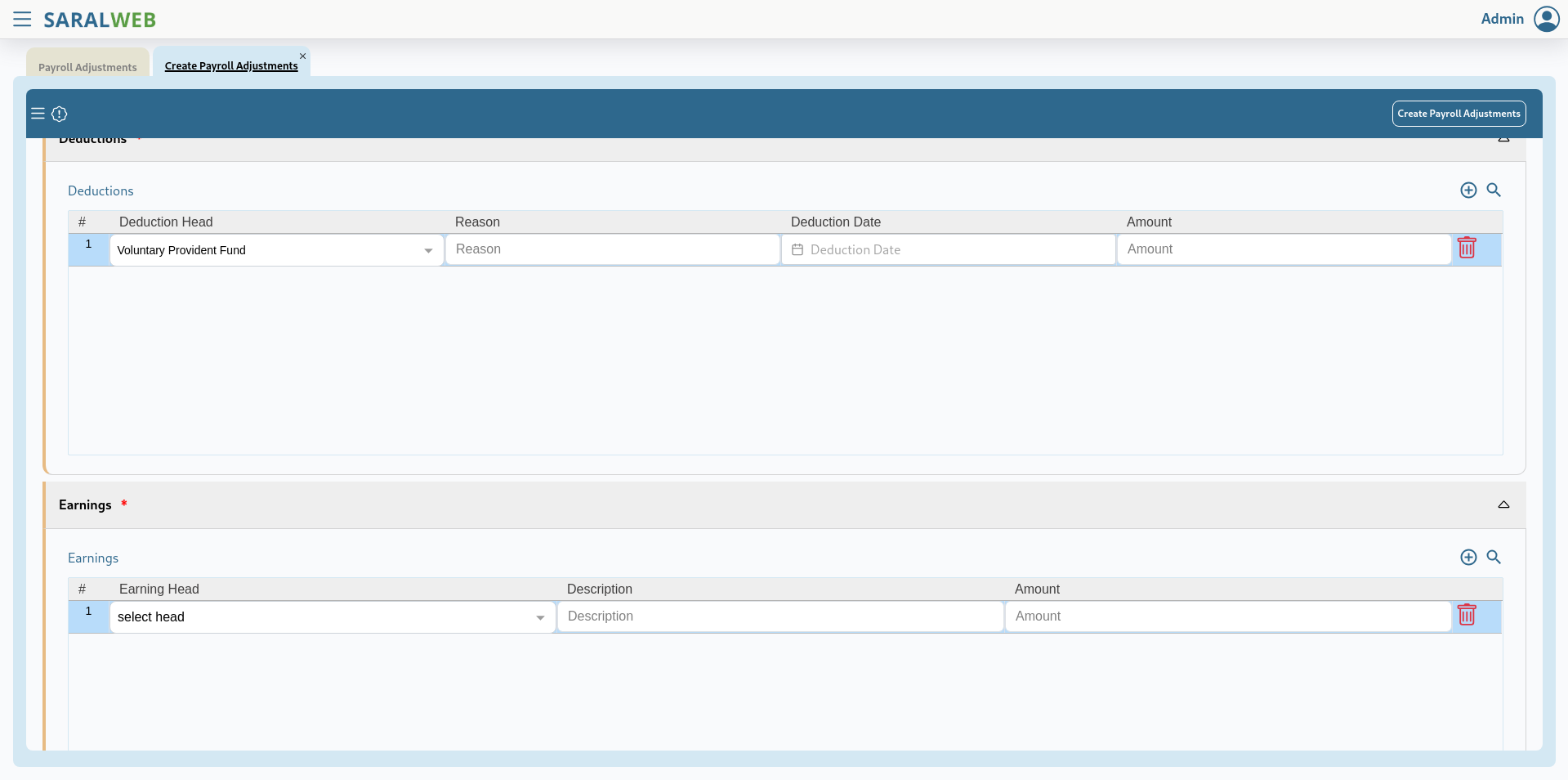

Deductions -

- Click on the add icon in front of the deductions

addDetail - A deduction row would be added. Fill in the following fields - Deduction Head : Using the drop down menu, select the head under which the deduction would be made. - Reason: Fill in the reason for the deductions - Deduction Date: Select the date on which the deduction is to be made - Amount: Fill in the amount that is to be deducted from the employees\' salary.- Earnings

- Click on the add icon in front of the EarningsaddDetail - A row would be added. Fill in the following fields - Earning Head : Using the drop down menu, select the head under which the employee has earned the respective amount - Description: Fill in the description for this addition.It is advised to fill in the description as it comes in handy when checking the records. - Amount: Fill in the amount that the employee has earned.- Click on the "Create Payroll Adjustments" button available on the top right hand corner of the screen. The payroll adjustment would be created and will be reflected in the payslips.